If you need to get caught up you can do that here!

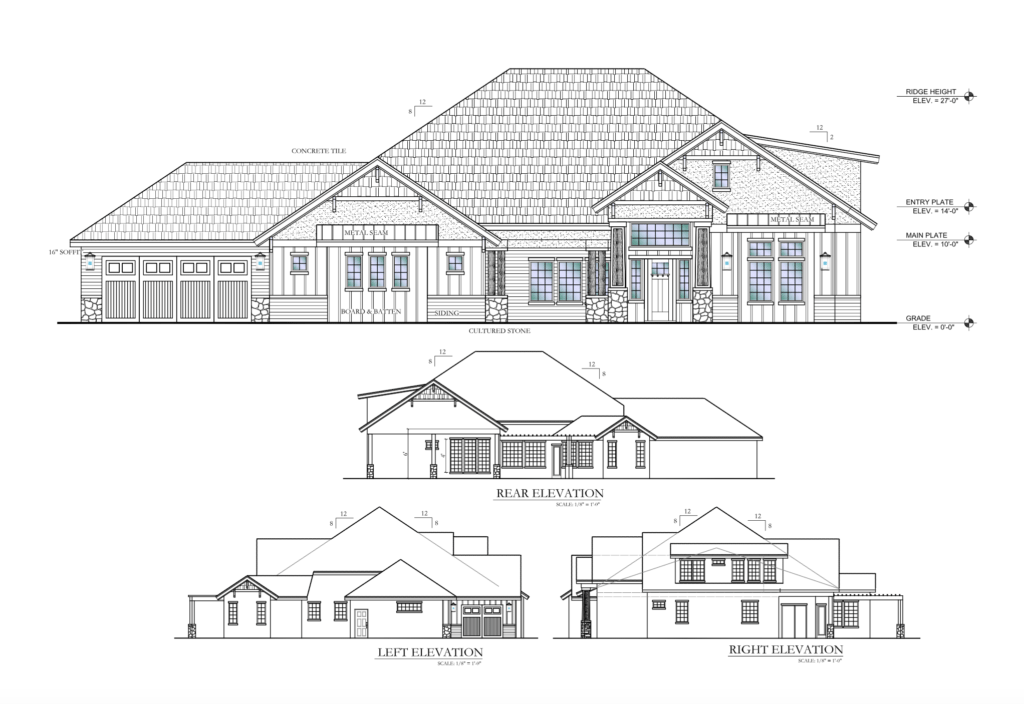

Where did I leave off? Oh yes, the elevation! It was so cool to finally be able to see what the outside of our house looked like! We went back and forth for a while ironing out the details of the exterior and making sure that everything in the floorpan was exactly what we wanted.

This house was my inspiration. I loved the colors, the wood details and the knee brackets.

One of the most eye opening things was that people do things like have beige houses for a reason. Living in such a harsh climate, things that I love (cedar shake I’m looking at you) just aren’t practical, or require serious maintenance. I would love a fair amount of stucco in the world to die, but it can’t. Cause cement board is 3x as much.

I think there is this thing that happens when you’re building a house that I didn’t realize was a thing until we got to this point. You have your non negotiable right? And then you have the things that you really really want. And you think that its ok to put a little extra money into things cause you can pull it from somewhere else, right?

Getting bids back showed me that there aren’t really that many places that you can pull from. I don’t know about you guys but I want to splurge on the things that I can see, and cut out the things that I can’t. Well the things that you can’t see sort of can’t be cut out. I can’t be the only one that experiences this phenomenon right?!

Another huge wheel that was in motion at this point (that I haven’t brought up yet) was our financing. If you are uncomfortable with money talk, feel free to scroll past this part!

Also, I’m openly sharing the financial side of this because so many of you requested it. Obviously talking about $$$ is a little unnerving so I’m sharing it in the hopes that you’ll be kind and respectful. ❤️

About 6 months before we decided to do this (so July/August of last year) we went in and met with our mortgage guy. We knew that it was eventually coming and we wanted to be as prepared as possible to get the best loan rates and know exactly what needed to happen rolling into it. We’ve done a fair amount of damage to our credit and knew that we would need to put a larger than normal downpayment to get a good rate. We wanted to be prepared (which is really hard for someone like me who lives by the seat of her pants.) He recommended that we didn’t get a loan over $416,000 because then it would be classified as a Jumbo Loan and there are a whole slew of hoops to jump through with that. So anything above $416k was our responsibility. We had about $150k to put down (after our current house sold). The blog also provides a really unique situation where I can collaborate with different brands and reduce the materials cost of some things. So we had a little bit of wiggle room. The bids in full and the lot price came back at over $600k. That meant it was our responsibility to come up with $184k+.

Thats a crap your pants moment. It wasn’t impossible, it just would have taken everything we had.

For the next lifetime.

And possibly my children’s lifetimes.

Its fine.

The biggest hurdle that we ran into though was that we couldn’t get a normal construction loan for the house. The lot that we wanted to build on wasn’t recorded yet (and wouldn’t be until Jan 2017) and you can’t get a loan for a piece of land that doesn’t exist on paper. Our only option was to go down the private funding road. The downside of this is that the rates are higher 7-11% and its a lot more complicated (I don’t know a lot of people who have $500k just hanging out).

I feel like up until this point I’ve touched on the actual events, but emotionally I was struggling with it. It seemed like every turn we were hitting a block wall, everything was doing the opposite of falling into place. You know the confused feeling of “is this not working because its not right, or because I’m not working hard enough to make it happen?” I felt that a lot. A LOT. So I would double down my efforts and it still wouldn’t work out. This was so much more than just a house. Not only am I putting my family’s home on the line but I’m putting all of our financial stability and my entire business into it as well. Everything was riding on this.

I remember so clearly sitting in my bedroom talking to Court one Saturday in June. We had just had a meeting with the developer and the builder and finally gotten all of the info that we needed for the private investor. The timeline was almost impossible. In order to get the loan we needed to put $184k (anything above the $416k that we had been prepared for) into an escrow account, which meant we needed to sell our house. STAT. Even if it sold that second and had no hiccups and the fastest 30 day closing of all time it was still a month before we could start the loan process with the investor. Then another 30 days to close on that. Then before we could actually start building we had to get permits and all of those fun things, which our builder was estimating being another 3-4 weeks. That meant that the house couldn’t actually start being built until End of Sept/ beginning of Oct. and because we were putting it in the homeshow it needed to be 100% finished/staged and perfect by mid January. That meant that all of the projects that I wanted to do, all of the cool Vintage Revivals touches, all of the tutorials that I wanted to share weren’t possible.

I was SO frustrated.

Back to my bed, I was sitting there talking to Court, running over the numbers and feeling all the feelings when I said “Maybe we’re not supposed to do this?” That was a thought that I hadn’t allowed myself to entertain at all. The only thoughts I had were along the lines of “THIS WAS HAPPENING I JUST NEEDED TO WORK HARDER.” As soon as I said “Maybe we’re not supposed to do this?” I had a huge rush of tingling confirmation hit me like a flood from the top of my head to the bottoms of my feet. That this was my answer. This was the answer to all of the prayers I had prayed. This was the answer to why things kept going haywire, this was it.

It wasn’t right.

So what does that mean?!!?

To be continued….

worst cliff hanger ever! can’t wait for part 5!

I agree…..I’m holding my breath!

I love you, even though we have never met. I adore your blog and your honesty and your willingness to listen intently and do what’s right even when it’s not what you want. It’s a relief to have answers, but still difficult to process. It will all work out! Hang in there! I’m excited to hear the update. Sending you love!

We tried to buy land and getting a land loan and then a construction loan when you don’t have a lot to put down is nearly impossible. So many hoops to jump through! We ended up just buying a house so that we’d have more time to think, save, whatever. The home building and buying process is the most stressful thing I’ve ever done and I’ve done it twice. Next time I’ll just erect a yurt in a field and call it good.

Uggghhhhh….. the suspense is killing me!!!

OMG, you’re so mean!!! What happens next!?

WHAT HAPPENED!?!?! Please, please know I will still come back to your blog regularly, even without cliff hangers 😉

Ahhhhhhhhh!

When we built it was so hard to focus on the non fun things and not put in all the fun pretty things. We ungraded all of our insulation and things that would make our house more efficient, which means stuff like floors and other fun stuff would have to wait. But after a hot summer in southern Utah, our utilities were about the same as our old house that was almost 1,000 feet smaller, so in the end spending more on those thing she have really paid off for us! I still want the pretty things though.

I’m loving this series in your blog! We are at the same crossroads…in the same town…and building is soooo expensive right now! ? i can’t wait to see what happens for you and your family!

Rude!! Lol loving this series.

I love a nice home, but I’d rather have a home in which in CAN dream, rather than that perfect DREAM home that keeps me strangled and unable to dream past the 4 perfect walls. Good luck with your decision, appreciating all your honesty.

I was getting so stressed out reading this as I remembered how stressful my home buying process was earlier this year. I was thinking, “Maybe they shouldn’t be doing this if it’s going to be this stressful.” We definitely had that moment when we decided to ditch our plan of renting our first home and sell it instead of trying to move, rent, refi, & secure a new home loan all at the same time.

Mandy…how can you leave us hanging here? So excited for your next post on this. Love your blog and everything you do! 🙂

I am one that can honestly say I’ve been in your shoes in this very situation. It is crazy stressful and the financial institution’s hoops to jump through are the worst part! But, know that it will work out how its supposed to. And in the mean time, you’ll have time to think about and build this house in your head multiple times and you’ll end up changing things that you didn’t think you would and it will be better than If you did it right this second.

Hurry and post… We love in Washington City and know where you want to build, love that area…

Yep, you’re killing me! I hope you post the next part soon!!

OMG Mandy you are killin me!

Thanks for writing about this. This is REAL LIFE. I love your honesty and vulnerability. And I love your blog!

if you need tile you know who to call

Good for you! Dreams are so hard to let go of, yeah? Maybe I should say “re-imagine”? CANNOT wait to see what you are looking at now!

To be honest, I was stressing more and more the further I got into that story, not because you were talking about money, but because of the debt load. I definitely don’t presume to know how much you and Court make but the term “Jumbo Loan”. Yikes.

Ahhhhhhh I’m dying to hear the rest!!!! I was seriously so stoked to come see your house in the parade of homes!!! But glad you were able to get the confirmation of what is right for your family! Can’t wait to hear more!

Talk about a cliff-hanger! But I TOTALLY understand what you mean about putting the $$ into the non-fun, can’t-see it stuff. We just built our house a year ago and sunk extra $ into making the garage bigger so we weren’t so darn tight getting in and out of vehicles & storing the snow blower/etc, extra insulation between some interior walls for sound (bathrooms) and a few extra windows, things like that. NO FUN! I wanted my fireplace shelves, my beautiful tiled shower, the laundry room completely tricked out! Why can’t we have it all? :)) But I totally get what another commenter said – then I wouldn’t have stuff to dream about, right? Ha! Good luck with it all!

Aghhhhhh!! You can’t stop there!!! I neeeeeeeed to hear more! On another note, we are designing and building a house right now so this is such a great time for me to get to read about your journey! Thanks for sharing!

You’re killing us with suspense, in the most awesome way! While I hate to hear about challenges you faced(because you are THE BEST cheerleader for us readers…and the world seems to LOVE to dump challenges on the best cheerleaders among us)-I will wait with baited breath for the next installment to this saga. And thank you, thank you, THANK YOU for talking about financing. It’s an integral part to every homeowner’s experience, and educating us all on your entire story is a gift.

I just skimmed the comments and I agree with Lauren-the yurt is where it’s at when you’re in the thick of the buying process:)

Im in southern California and 600k for a detached 3-4 bedroom home is the norm for many of our cities. Also many of our friends had to go with a jumbo loan. It’s insane but location can be a non-negotiable with commute times here. Some friends have moved further out and worked out a partial telecommuting plan with employers to make it work.

i totally know what you mean by that feeling of knowing you finally have your answer. the answer that you’ve maybe had in the back of your head all along but refused to see or hear or just totally didn’t even really notice until it finally comes out of your mouth and you have a sad but relieved feeling kind of? at least that’s how mine usually go with big decisions/answers like that. can’t wait to hear the rest. ps your inspiration house is amazeballs. i want that too!

Oh my lands, what a stressful situation. No wonder you were side-swiped by depression; how could any human not be?

We’re currently house planning and saving for down payment and we are not poor, okay, but the amount you would have had to put down and then take out in debt would give me migraines, nightmares, and anxiety until it was paid off. That is HUGE. Wow. The gut is a wise thing.

Just want to echo so much of what’s been said and say thank you for sharing your experience! My husband and I were in a similar situation not too long ago, and it’s so difficult to allow for changes in plans that you’ve been working on long and hard! But I’ve learned that it’s always worth it to listen to the answers we get to prayers, because no matter how awesome our plans may have been, the Lord’s plans for us really are better. Good for you! Can’t wait to see what’s next 🙂

ahhhhhhhhhhhhhh, now what?

Speaking as a wife of a builder, you absolutely do not want to scrimp on the stuff you cant see!!! You really don’t want to live in a beautiful piece of garbage! You can always upgrade the pretties over time.